Bitcoin & Global Liquidity: Can the orange coin absorb it all?

In today’s interconnected financial system, an invisible tide sweeps through every corner of global markets—one that shapes asset prices, funds investment booms, and ultimately determines winners and losers in the wealth-creation race. That tide is global liquidity: the cumulative pool of money available for borrowing, lending, and investing across economies.

Over the past two decades, scholars and traders alike have come to recognize that shifts in global liquidity—not conventional measures of money supply—drive the most powerful asset‑price cycles. And nowhere has this sensitivity been more dramatic than in Bitcoin, the world’s first truly global monetary asset.

This article begins by unpacking the concept of global liquidity—its origins, how it’s measured, and why it oscillates in predictable cycles—drawing principally on Michael Howell’s seminal analysis of the Global Liquidity Cycle, which he continues to share with the world today.

From there, we will explore Bitcoin’s evolution from niche experiment to trillion‑dollar market and demonstrate how Bitcoin’s price has historically reacted to liquidity swings.

Finally, we’ll set the stage for a forward‑looking argument: in an era of perpetual central‑bank accommodation and expanding private‑sector balance sheets, Bitcoin’s finite supply and borderless accessibility position it to absorb the majority—if not all—of the world’s incremental liquidity.

What Is Global Liquidity?

Unlike traditional monetary aggregates (M1, M2), which capture net changes in money stock, global liquidity measures the gross capacity of the financial system to create funding.

Howell defines it as the sum of private‑sector savings plus changes in financial liabilities—essentially, the funding sources that flow through banks, shadow banks, and corporate balance sheets into asset markets. In 2023, that funding pool stood near US$170 trillion, spanning nearly 80 economies.

At its core, liquidity is a balance‑sheet concept: sources of funds (savings plus new borrowing) must equal uses of funds (investment and asset accumulation). When collateral values rise, they spur additional lending, creating a powerful feedback loop that can dwarf the impact of pure savings growth alone. This elasticity, or “banking glut,” is what transforms small shifts in credit conditions into vast surges of liquidity.

Measuring and Timing the Liquidity Cycle

Howell’s Global Liquidity Index (GLI) standardizes these flows on a 0–100 scale, with 50 representing long‑run average momentum. By comparing the GLI to a historical sine wave (average cycle length ≈65 months), Howell projects peaks and troughs in liquidity with surprising accuracy.

Trough (December 2022): GLI bottomed at 11.8

Rebound (September 2023): Rising liquidity below average

Next Peak (Fall 2025): Liquidity expected to crest near cycle highs

These inflection points matter because they coincide with distinct asset‑allocation regimes—from “Rebound” (early recovery) to “Speculation” (late‑cycle exuberance) and “Turbulence” (liquidity withdrawal and market drawdowns).

Why Liquidity Drives Asset Prices

The slope of the U.S. Treasury yield curve—specifically the 10‑year minus 2‑year spread—provides a real‑time barometer of liquidity conditions. When liquidity is abundant, investors exit “safe” Treasury holdings in favor of riskier assets, steepening the curve by raising long‑term term premia. Conversely, tight liquidity flattens the curve as demand for safety surges.

Historically, more than 80% of variation in 10‑year yields since 2000 has been attributable to term‑premium shifts rather than changes in expected Fed policy rates. This linkage underscores how powerful liquidity flows have become relative to conventional monetary policy tools.

Bitcoin: A New Frontier in Liquidity Absorption

Bitcoin’s emergence in 2009 coincided with the global financial crisis and the birth of large‑scale quantitative easing (QE). Over the past 16 years, Bitcoin has demonstrated three key traits that differentiate it from every other asset:

Fixed Supply: Only 21 million BTC will ever exist

Global Accessibility: Permissionless, 24/7 markets with near‑instant settlement

Scarcity Premium: Increasingly viewed as a non‑correlated store of value

Because Bitcoin’s market cap remains small relative to the GLI today (~US $1.7 trillion vs. US $170 trillion), it has absorbed outsized flows whenever liquidity has surged. From 2019–2021, Bitcoin’s price rose nearly tenfold even as global equity markets merely doubled—underscoring Bitcoin’s acute sensitivity to rising liquidity.

Having established Bitcoin’s unique capacity to soak up incremental liquidity—thanks to its fixed supply, global reach, and growing institutional legitimacy—it’s time to see that capacity in action.

The next sections spotlight real‑world use cases where Bitcoin isn’t just a speculative asset but an active counterparty in traditional finance. We begin with one that might not even be the most compelling: how Bitcoin is reshaping real estate lending through dual‑collateral loan structures, and simultaneously becoming an attractive option for pension funds.

Bitcoin-Backed Real Estate and Pension Lending

One striking example of Bitcoin absorbing liquidity is in the real estate lending market. New Market Capital’s innovative “Battery Finance” model essentially fuses property assets with Bitcoin as loan collateral.

In practice, this means a borrower can refinance a real estate mortgage and split the loan collateral between the physical property and a chunk of Bitcoin held in escrow.

For instance, New Market’s first deal in late 2024 refinanced a Philadelphia apartment building with the building itself plus ~20 BTC as collateral. The genius of this dual-collateral approach is that it unlocks new combinations of value for both borrower and lender.

What makes it even more innovative is that the bitcoin collateral can be bitcoin already held by the borrower or purchased by the borrower and New Market Capital.

In the example above, New Market provided a loan in the amount of $12.5M. $9M was used to pay off the existing loan, and $2M was used for building improvements. The remaining $1.5M was used to purchase the ~20M bitcoin which is held in escrow.

Both the borrower and the lender benefit because the bitcoin cannot be sold for a long period of time (~4 years). The lender gains a second, uncorrelated asset backing the loan, which hedges risk from any one collateral source.

From a big-picture perspective, this model is poised to attract institutional players like pension funds. Why? Pension funds crave steady, reliable returns (to match their long-term liabilities), but traditional safe assets like bonds often yield too little, forcing pensions into riskier bets.

Battery Finance offers a compelling alternative. By combining a stable income-producing asset (real estate) with a high-growth asset (Bitcoin), the overall loan’s risk-adjusted return improves.

The Bitcoin portion can boost long-term returns without the pension taking on the full volatility of holding BTC outright. And because the loan is secured by real estate first and foremost, lenders aren’t flying without a net.

As James Lavish observes, this dual-collateral setup reduces single-point risk – if the property’s value falters, the Bitcoin collateral is there to compensate, and vice versa.

For pension funds, the result is higher returns per unit of risk compared to sticking purely with bonds or traditional securities backed by mortgages. In plain English, it’s a win-win: pensions get exposure to Bitcoin’s upside in a structured, downside-protected way, potentially helping to close their funding gaps, while global Bitcoin adoption quietly expands via these loan agreements.

Philosophically, this trend hints at how Bitcoin can seep into the old guard of finance. We’re talking about some of the most conservative pools of capital – pension and real estate credit markets, which are measured in the tens of trillions globally.

If even a small slice of that capital begins riding on Bitcoin-backed loans, that’s a significant flow of liquidity into the Bitcoin ecosystem. It’s a subtle form of adoption (wrapped in a traditional loan structure) that aligns with fiduciaries’ needs.

One can imagine a future where a chart of institutional loan portfolios shows a growing segment tagged “Bitcoin-enhanced loans.” Such a chart might resemble the early days of mortgage-backed securities or infrastructure loans – a new asset category born from financial engineering – only this time, powered by BTC.

In sum, Bitcoin-backed real estate lending demonstrates Bitcoin’s ability to integrate with legacy assets and attract institutional liquidity, all while appealing to very traditional goals (like stable income and capital preservation). It’s a quiet revolution where Bitcoin becomes the battery charging the engine of long-term finance.

Spot Bitcoin ETFs: Bitcoin’s Mainstream Bridge

If Bitcoin-backed loans are a subtle integration, spot Bitcoin ETFs are a much more visible one. When the U.S. SEC approved the first spot Bitcoin exchange-traded funds in January 2024, it marked “the moment that crypto’s gone mainstream,” as Coinbase’s institutional head put it.

A spot Bitcoin ETF wraps BTC in a familiar, regulated investment vehicle. This means everyday investors and big institutions alike can now buy Bitcoin as easily as buying a stock index fund – in their normal brokerage accounts, without dealing with crypto exchanges or wallets. In effect, spot ETFs provide a “scalable bridge from traditional finance to crypto”, channeling streams of capital from the old world into the new.

The impact of this bridge has been immediate and dramatic. Trading volumes for these Bitcoin ETFs exploded into the billions of dollars per day after launch. In fact, within weeks, net flows into Bitcoin ETFs were outpacing those of even the most successful commodity ETF launch (gold in the early 2000s).

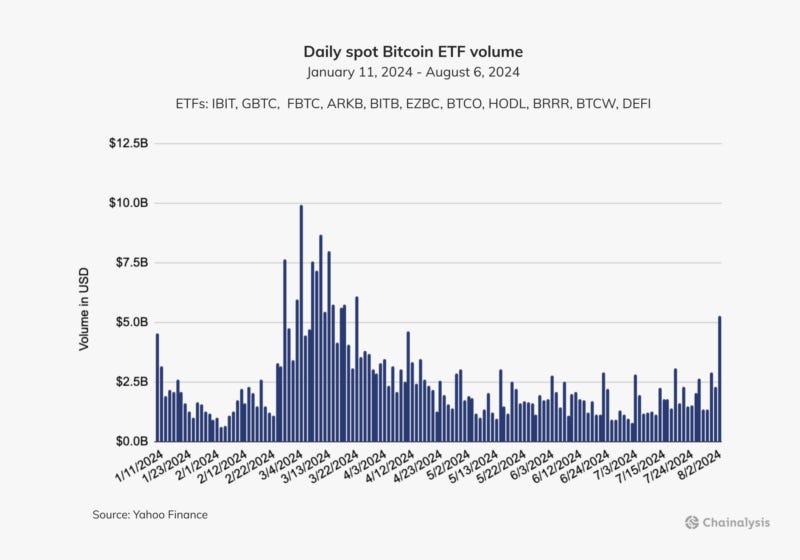

Consider the chart below, which illustrates daily spot Bitcoin ETF volumes in the months after approval – peaking near $10 billion in a single day by March 2024. It’s a visual testament to how much pent-up demand existed once the door to mainstream investment opened.

With billions of dollars in inflows since day one, these Bitcoin ETFs collectively became the most popular ETF debut of all time. In other words, Bitcoin didn’t just step through the door to mainstream finance – it kicked it off the hinges, drawing in a flood of capital.

Why does this matter for global liquidity? Because ETFs are the vehicle of choice for trillions of dollars of investable wealth. Pension funds, mutual funds, 401(k)s, sovereign wealth funds – they all use ETFs to get exposure to assets. Now that Bitcoin lives inside that ecosystem, it’s as accessible as any stock or bond.

A portfolio manager can allocate 5% to Bitcoin with a few clicks, when before they might have been unable or unwilling to navigate crypto custody. This is Bitcoin’s full entrance into Wall Street’s universe. And the players entering are not just crypto enthusiasts, but the BlackRocks and Fidelitys of the world.

For instance, BlackRock’s iShares Bitcoin Trust (IBIT) quickly attracted over $20 billion in assets within months, surpassing even the long-standing Grayscale trust in size. Such figures underscore a new reality: Bitcoin is becoming a staple in diversified portfolios, viewed increasingly as “digital gold” by finance titans who once scoffed at it.

We can imagine a forward-looking chart of ETF inflows over time, showing a steep upward curve for Bitcoin alongside more tepid flows into other asset ETFs – a sign that a new asset class is claiming its share of global capital.

On a philosophical note, the advent of spot ETFs represents a form of legitimization and perhaps an inevitability. It’s the financial system acknowledging that Bitcoin is here to stay by weaving it into its very fabric (regulatory approvals, ticker symbols, annual reports, and all). I

In doing so, Bitcoin is absorbing liquidity not as a renegade outsider, but from within the system. One might say Bitcoin has infiltrated the castle of traditional finance. The genie is out of the bottle: going forward, every uptick in global liquidity (say, a central bank easing or a surge in savings) has a clear, sanctioned path into Bitcoin via ETFs.

The mainstream bridge is built, and traffic is flowing. From here, Bitcoin’s market will likely swell with each new pension plan that adds an allocation or each model portfolio that includes a dash of BTC for diversification. It’s no longer speculative to say institutional money is coming – it’s already arrived, en masse, and it’s only gaining momentum.

Corporate Bitcoin Treasuries

Another avenue through which Bitcoin is absorbing capital is corporate treasuries. Perhaps the poster child for this movement is Michael Saylor and his company, MicroStrategy (now rebranded as “Strategy”).

Back in 2020, Saylor made the groundbreaking decision to convert a large portion of his company’s cash reserves into Bitcoin, citing concerns about dollar inflation and the desire for a harder store of value.

At the time, it was a radical move – effectively swapping out cash for Bitcoin on a publicly traded company’s balance sheet. Fast forward to today, and that “radical” strategy has snowballed: Strategy/MicroStrategy has aggressively added to its holdings ever since, even issuing convertible notes and new shares to buy more Bitcoin. The result? The company now holds roughly 506,137 BTC on its balance sheet (As of March 28, 2025).

To put that in perspective, one mid-sized tech company controls about 2.5% of the entire Bitcoin supply. That is an astounding figure – about one out of every 50 bitcoins that will ever exist is in the treasury of this single firm.

Saylor has memorably analogized this strategy to buying up Manhattan real estate in the 1700s – as the value goes up, you leverage it to buy even more, compounding your holdings. And indeed, Strategy has treated their Bitcoin stash like a growth asset to build upon, not just a static reserve.

This approach has inspired others. A few other publicly traded companies, notably in the crypto mining sector, have followed suit by holding onto the Bitcoin they mine (instead of immediately converting to cash).

For example, Marathon Digital Holdings (MARA) and Riot Platforms have each accumulated a significant bitcoin treasury, effectively adopting a similar belief that BTC belongs on the balance sheet.

Even Tesla made waves in early 2021 by purchasing $1.5 billion in Bitcoin for its corporate treasury, signaling that Fortune 500 companies see merit in holding some “digital gold” alongside cash. While Tesla later trimmed its position, the message was sent loud and clear.

What’s the forward-looking significance of this trend? Corporate balance sheets worldwide collectively hold trillions in cash. These are funds parked for stability, rainy days, or strategic acquisitions – traditionally kept in ultra-safe instruments like T-bills.

Bitcoin is now vying for a larger slice of that pie as a treasury reserve asset. If more companies emulate Saylor’s playbook (even on a smaller percentage basis), we could see a substantial wave of corporate liquidity flow into Bitcoin.

This would further solidify Bitcoin’s status as “corporate gold.” It’s not hard to imagine quarterly earnings reports in a few years where CEOs proudly report on their Bitcoin holdings or where analysts ask companies about their digital asset strategy as a standard question. In fact, entire financial services are springing up around this idea – from custodians offering secure storage for institutional BTC, to insurance products for crypto assets on balance sheets.

Philosophically, corporations adopting Bitcoin blurs the line between the traditional financial world and the crypto realm even more. Companies are essentially voting with their treasury dollars, expressing a long-term bet on Bitcoin’s value.

MicroStrategy’s extreme example illustrates a broader point: Bitcoin can serve as a strategic reserve for entities other than central banks. We used to think only governments hoarded reserve assets (like gold, currencies, etc.), but now private enterprises are doing something analogous with BTC.

In doing so, they are absorbing excess liquidity (say, proceeds from a bond issuance or cash from operations) and channeling it into the Bitcoin network. One could envision a bar chart of top Bitcoin holders that, in addition to Satoshi’s stash and exchange reserves, shows corporate treasuries and ETFs climbing up the ranks.

As of early 2025, aside from a major ETF, MicroStrategy is the single largest institutional holder of Bitcoin – a remarkable shift from just a few years ago when no such category even existed. The takeaway is that Bitcoin has become a strategic asset at the corporate level, not just a speculative investment.

And as more CEOs and CFOs come to that conclusion, more corporate cash will be siphoned into the Bitcoin ecosystem, tightening the supply and boosting Bitcoin’s role in global capital allocation.

State-Level and Sovereign Bitcoin Reserves

Another quite profound indication of Bitcoin’s growing role is its adoption as a reserve asset by governments themselves. In the United States, a grassroots movement has emerged at the state level to allocate public funds into Bitcoin.

In the past year, over two dozen U.S. states have proposed bills to create state Bitcoin reserves. These proposals typically suggest investing a portion (often around 10%) of the state’s rainy-day fund or reserves into Bitcoin.

The rationale is similar to why a state might hold gold or a robust investment portfolio – to protect and grow the public’s funds for the future. States like Pennsylvania (the first to introduce a Bitcoin reserve bill) and Texas (which leads the nation with multiple active Bitcoin reserve bills) have been at the forefront.

Ohio’s proposal would even empower its state treasurer to buy Bitcoin at any time as market conditions warrant. Even states traditionally cautious with finances, like Alabama and Utah, have seen lawmakers pushing for a slice of Bitcoin in their treasuries.

It’s a bipartisan mix of motivations – some see it as a hedge against federal monetary policy, others as a growth investment, and others as a tech-forward move to signal friendliness to the crypto industry.

While as of early 2025 most of these bills are still in committee or awaiting votes, the momentum is undeniable. Nearly 18 states are actively advancing such legislation through various stages.

It’s as if Bitcoin is the new kind of “infrastructure” that states want to invest in – not roads or bridges, but a financial rail for the future. The philosophical shift here is significant: local governments are recognizing Bitcoin as an asset worthy of long-term holding, something that can strengthen their financial position over time.

At the federal level, things have moved even faster. In March 2025, the U.S. federal government officially established a Strategic Bitcoin Reserve (SBR) by Executive Order. For context, the U.S. has long maintained a Strategic Petroleum Reserve (SPR) for oil; now Bitcoin is getting a similar treatment as a strategic asset.

The initial approach of the U.S. SBR is conservative but telling: rather than immediately buying bitcoin on the open market (which could be expensive and politically contentious), the government will retain the Bitcoin it has seized from criminal cases and hold those in reserve.

Over the past decade, the U.S. has accumulated a significant trove of confiscated BTC – roughly 200,000 BTC at present – through raids on darknet markets, hacking busts, and other forfeitures.

Historically, those bitcoins were auctioned off (famously, many were sold for peanuts in the early 2010s). But under the new policy, no seized Bitcoin will be sold; it will be kept as part of the strategic reserve.

Moreover, the order encourages agencies to find “budget-neutral” ways to acquire additional Bitcoin – for example, using proceeds from other seized assets or swaps – meaning the government is eyeing growth of its position without direct taxpayer expense. In one fell swoop, the United States has signaled that Bitcoin is considered a valuable strategic holding, enough to safeguard in the national interest.

Think about the symbolism here: a decade ago, Bitcoin was often associated with illicit online markets in the eyes of authorities. Now those very bitcoins are being repurposed as a national strategic asset to be protected and held for the long term.

It’s a profound validation of Bitcoin’s role. And the U.S. isn’t alone – we’ve seen countries like El Salvador adopt Bitcoin as a national reserve (and legal tender, in their case), and others like Bhutan quietly accumulate Bitcoin as part of their sovereign wealth strategy.

The sovereign level is the final boss of finance; if that trend continues, Bitcoin will officially join the likes of gold and foreign currencies as part of the backbone of global finance.

Today that slice is modest (roughly $17+ billion worth for the U.S., based on seized coins), but tomorrow it could grow. If states start buying, if the federal government starts allocating budget to Bitcoin, or if other nations follow suit, we could see a scenario where hundreds of billions of dollars of sovereign liquidity flow into BTC.

Bitcoin would effectively be absorbing a share of the world’s reserve capital. It’s both an economic and a geopolitical development: countries may feel compelled to hold Bitcoin if others do, so as not to be left holding only depreciating paper when a new form of digital reserve is in play.

The Inevitable Absorption of Global Liquidity

From niche experiment to strategic asset – the trajectory of Bitcoin is evident in each of these stories. What we are witnessing is Bitcoin maturing into a global liquidity sponge, soaking up capital from every corner.

It’s happening in the shadows of mortgage deals and pension strategies, in the splashy headlines of ETF launches, in corporate boardrooms, and in the halls of government.

Each channel reinforces the others: as more money flows in, Bitcoin’s market deepens, volatility gradually tempers, and it becomes even more attractive to the next big pool of capital. This positive feedback loop suggests that Bitcoin’s role in global capital flows is not speculative or transient – it is entrenched and growing.

Will this trend continue? All signs point to yes. Consider that global liquidity (the sum of money sloshing through economies) tends to seek assets that offer yield, safety, or growth. Bitcoin uniquely offers a bit of all three: it has high long-term growth potential, it’s nobody’s liability (a safety characteristic).

As central banks expand money supply or as investors seek refuge from inflation, that liquidity will naturally gravitate toward assets like Bitcoin, especially now that the gateways are open. In a sense, Bitcoin has become an inevitability in portfolios.

A pension fund manager might not love Bitcoin, but if their peers are enhancing returns with Bitcoin-backed loans, they’ll feel pressure to consider it. A family office might have dismissed crypto, but once Bitcoin ETFs show a strong track record, ignoring it could mean missing out on uncorrelated growth.

A corporate CFO might still be cautious, but seeing MicroStrategy turn a ~$30 billion investment into $40+ billion of value will make them at least ask the question, “Should we put a smidge of our cash into BTC?”

And a nation’s central bank, observing the U.S. Strategic Bitcoin Reserve, might well start accumulating a bit on the side – just in case.

In the end, the theme is clear: Bitcoin is integrating into the global financial system at every level. This multifaceted absorption of liquidity underscores a future where Bitcoin isn’t just riding the waves of global finance – it is part of the foundation, helping to shape those waves.

Far from being a speculative toy on the sidelines, it’s becoming the bedrock in many portfolios and balance sheets. The conversation is no longer “if” or “when” will big capital enter Bitcoin; it’s already happening in real time.

And those flows, once started, tend to reinforce and accelerate. Just as the internet quietly and then not-so-quietly infiltrated every industry, Bitcoin is permeating finance.

The conclusion is as powerful as it is simple: Bitcoin’s role in global capital flows is inevitable – not because of hype, but because of the logical, step-by-step way in which it has proven itself useful to very different stakeholders with very different needs.

The world’s liquidity is searching for a home in an era of unprecedented monetary expansion and uncertainty. Bit by bit, it’s finding that home in Bitcoin. And as that trend continues, it will transform our financial landscape in ways we are only beginning to understand.

References:

Lavish, J. (2024). Bitcoin Battery Finance – The Informationist, Issue 143

Dakota Fundraising News. (2024). Newmarket Launches Battery, a Bitcoin-backed Specialty Finance Platform

Chainalysis Team. (2024). Spot Bitcoin ETFs: Everything You Need to Know

Jansen, E. C. (2024). Bitcoin Goes Mainstream: BlackRock’s Pivotal Role in Institutional Adoption – Finivi

Hitchcock, L. (2025). Michael Saylor’s Bitcoin Strategy – Decrypt

Torpey, K. (2025). Strategy Buys Almost $2B More Bitcoin, Stash Nears 500,000 BTC – Investopedia

Jha, P. (2025). Race to Bitcoin Reserves: Which US States Are Taking the Lead – CCN

Lavish, J.(2025). What is a Bitcoin Strategic Reserve? – The Informationist, Issue 157